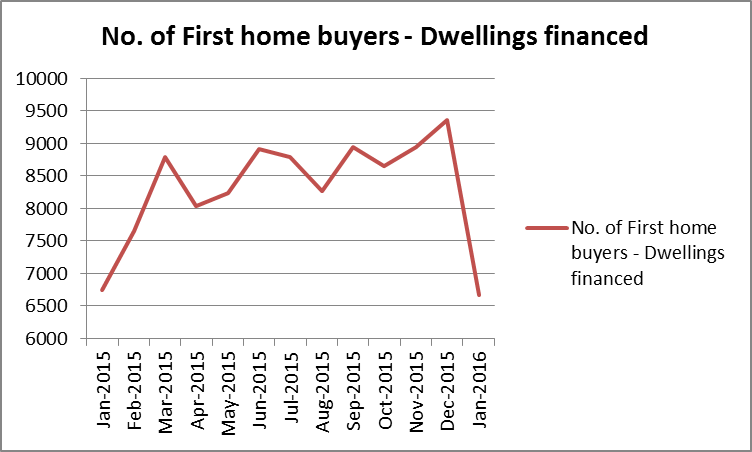

Housing finance data for January 2016 was released today by the Australian Bureau of Statistics (ABS). The report showed that the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments remain unchanged at 15.1% in January 2016 compared with December 2015. However, more concerning was that in comparison to January 2015 – the proportion of first home buyer finance commitments dropped from 15.9% to 15.1%.

(Source: Australian Bureau of Statistics – ABS)

Furthermore, the ABS data paint a somber picture for First Home Buyers. Only 6,669 Dwellings were financed by First Home Buyers in January 2016, which is the lowest monthly number since February 2011 (6,069 dwellings).

First Home Buyers Australia (FHBA) c0-founder Taj Singh said “these latest stats further emphasize the need for urgent reforms to assist a greater number first home buyers get into the property market. We welcome the Labor party recently putting housing affordability on the agenda. We are waiting to see how the Liberal party will respond. If they need help, we recommend the Liberal party take a look at our 5 point plan”.

Last year FHBA launched a 5 point plan to address housing affordability and assist aspiring first home buyers. The 5 point plan includes reducing investor tax incentives as well as providing more first home buyer assistance.

Fellow FHBA co-founder Daniel Cohen said “we will continue to lobby the Government in this election year for more assistance for first home buyers”.

Are you not sure where you can afford to buy a property in? Try the new Where Can I Afford tool on our website.

The source for the statistics in this article was the Australian Bureau of Statistics. Learn more here.