FHBA Market Update: 13 June 2017

In last week’s FHBA Market Update we wrote about how the tide may be starting to turn in the favour of the first home buyer, highlighting:

- The softening of property prices in many of our capital cities over the last few months;

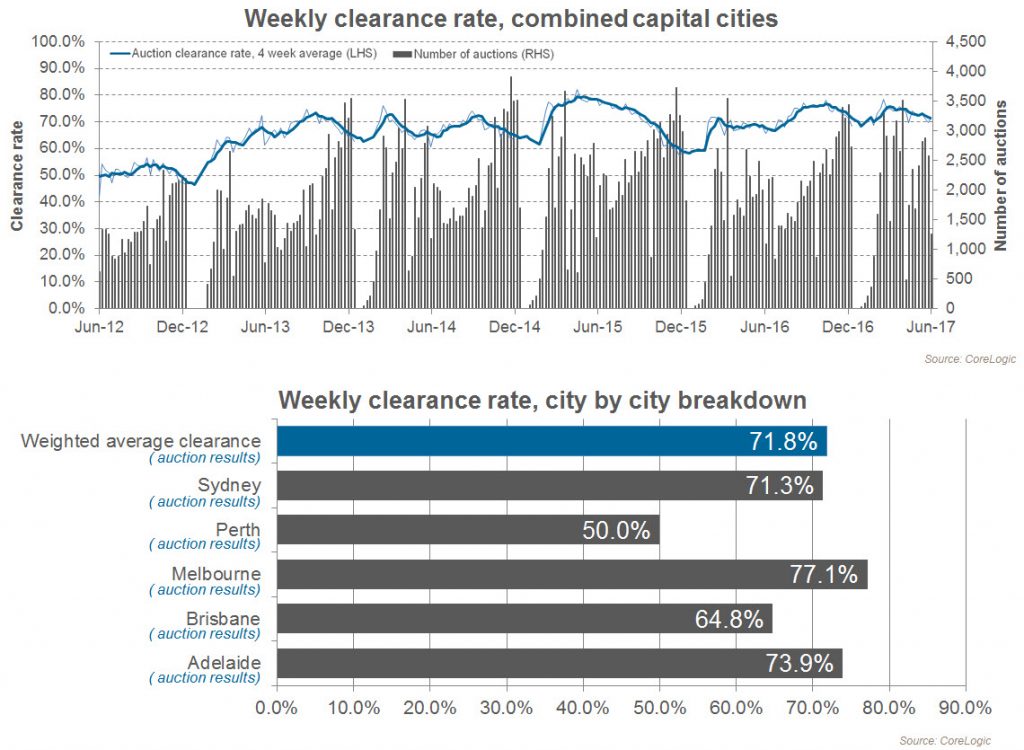

- Slight decreases in auction clearance rates in recent weeks;

- Increased first home buyer government incentives for Australia’s two most expensive states, NSW and Victoria commencing from 1 July;

- A proposed new national scheme to help Australians save a deposit sooner from 1 July (First Home Super Saver Scheme);

- Toughening conditions for local and foreign investors due to tougher lending rules and changes to several taxes

With this in mind, we are now calling on Australia’s property developers to start focusing on building more affordable housing suitable for first home buyers. For example, why is it that apartments are built with so many luxurious features these days (and are priced so high accordingly)? Traditionally, apartments were built for those on a tight budget, as an affordable entry level option.

At FHBA we would like to see more basic apartments, townhouses and terraces built, as part of the total building mix. We will be voicing this in the media and to politicians throughout the rest of the year.

In other news, this week’s auction clearance rate for Sydney was down on previous results, however overall auction activity across the nation was lower than usual due to the long weekend for the Queen’s Birthday in some states. Many more auctions are scheduled for the weekend ahead. Meanwhile, property prices are continuing to track slightly lower in many capital cities according to the CoreLogic Daily Home Value Index.

Enjoy reading the rest of our weekly FHBA Market Update!

First Home Buyer News

- Calls for property developers to focus on building housing appropriate for first timers – FHBA co-founder Daniel Cohen has called on property developers to stop building upmarket, luxury housing and instead focus on building more affordable, entry level properties for first home buyers – see Daniel’s interview on realestate.com.au

- Could ‘Naked’ homes help solve housing affordability? – Australia’s federal and state governments have talked about the need for more affordable housing supply through additional land releases and fast tracking building approvals. But the other major cost associated with new housing is the buildings themselves. Could building the bare basics help make housing more affordable? – see how it’s being done in London via Domain

- RBA leaves the cash rate on hold at a record low – Last week the Reserve Bank of Australia left opted to the cash rate on hold at 1.50% – learn why in FHBA News

Capital City Property Prices Movement – as at 13/June/2017

Updated daily, The CoreLogic Daily Home Value Index show’s how property prices have been changing in our largest capital cities over the last 12 months:

- Adelaide: 483.84 (Qtr + 1.0% / Yr + 2.5%)

- Brisbane: 556.32 (Qtr + 0.9% / Yr + 4.0%)

- Melbourne: 890.38 (Qtr – 1.2% / Yr + 11.6%)

- Perth: 574.86 (Qtr – 0.4% / Yr – 0.1%)

- Sydney: 1093.96 (Qtr – 1.1% / Yr + 11.2%)

(Source: CoreLogic)

Preliminary Weekend Auction Clearance Rates (10 – 11 June 2017)

Source: CoreLogic

Interest Rates Update: 12/June/2017

Last week the Reserve Bank of Australia (RBA) left the official cash rate on hold at a record low of 1.50%, while on Friday ANZ announced a small home loan interest rate cut outside of the RBA (which is very rare). However, this does not necessarily mean ANZ should be whom you should get your first home loan with. There is a lot to consider and there are hundreds of home loan products that you can compare and choose from.

- Compare a range of high interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

- Learn more about the RBA rate decision

New Homes of the Week (edition 58)

These are our top picks for First Home Owner Grant (FHOG) eligible properties this week! All offer affordable options for aspiring first home buyers.

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Tweet of the Week

Will first home buyers finally get the 'upper-hand'? https://t.co/GerK4F19rt #FHBA #ausproperty #auspol #realestate

— FHBA (@fhba_com_au) June 8, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia