FHBA Market Update: 17 July 2017

In today’s FHBA Market Update we take a look at the very latest on the First Home Super Saver Scheme, calls for the First Home Owners Grant to be extended to include established housing (rather than just ‘new’ housing), rising first home buyer activity in Queensland, our new hotspot in focus, our latest favourite properties for first home buyers, the latest property prices, the weekend auction clearance rates around the country and a whole lot more.

First we start with the latest on the First Home Super Saver Scheme. Earlier this year the Turnbull government proposed a new housing affordability strategy designed to address housing affordability and help first home buyers enter the property market. A key center piece of the proposal was the First Home Super Saver Scheme (FHSSS) which was outlined by Treasurer Scott Morrison in the budget. In summary, the proposal is:

- From 1 July 2017, individuals can make voluntary contributions of up to $15,000 per year and $30,000 in total, to their existing superannuation account to save for their first home deposit (so long as you don’t go over your superannuation concessional cap)

- These contributions will be taxed at 15% on entry into the superannuation fund (the same tax rate as your normal employer super contributions)

- Investment earnings will be taxed at 15% in the superannuation fund (the same tax rate as current superannuation investment earnings are taxed at when in accumulation phase)

- Contributions under this scheme will have a deemed rate of return

- Withdrawals will be taxed at the account holders individual marginal tax rate, less a 30% tax offset

- Withdrawals will be allowed at anytime from 1 July 2018 (if you are an eligible first home buyer)

- The administration of eligibility will be run by the Australian Taxation Office (ATO)

- Withdrawal requests (which can occur from the 1st of July 2018) must go through the ATO who will work out the withdrawal amount based on your voluntarily super contributions, the caps, deemed investment earnings and the concessional tax.

- It will NOT be dependent on the type of property you buy (i.e. you may buy a new or existing dwelling) but the purpose must be to live in it (i.e. you cannot be purchasing the property as an investor).

The government planned for the FHSSS to commence from the 1st of July. However, so far, the FHSSS is yet to be formally introduced to Parliament by the Coalition government as we revealed in a recent FHBA Market Update. Why? According to a Treasury spokesman who spoke to NewsCorp last week “the government is working through detailed design issues in the course of developing the legislation”.

There are many questions left unanswered. FHBA has expressed to the Assistant Treasurer’s office that the government has been poor at communicating updates on the FHSSS to the public. Perhaps one of the biggest questions is “can I make a voluntary contribution yet?”

The Treasurer finally made a public statement on Friday that answers this. The statement states “for the FHSSS, voluntary contributions made from 1 July 2017 will be eligible for withdrawal (provided all criteria are met) from 1 July 2018. Legislation will be introduced well ahead of the commencement date to provide certainty to savers and sellers”.

In other words, legislation will include wording that is essentially ‘backdated’ to include voluntarily super contributions from 1 July 2017 for those who meet the eligibility criteria. This means you can start salary sacrificing for a housing deposit, however, you bear the risk that you may not be able to access the funds in a year’s time.

For example, one key risk is that you may meet the proposed eligibility criteria but the eligibility criteria that becomes law may be different to the proposal. Neither FHBA or the government want to scare you, but you must understand the risks before taking any action. Especially given both the Labor Party and The Greens have both stated that they won’t support the FHSSS in Parliament.

For more information (in particular for those who are considering commencing voluntary contributions) we highly recommend you read the full government press release (including the factsheet) on the Treasurer’s website.

More First Home Buyer News

- Calls for First Home Owners Grant to be extended to include established housing – The Real Estate Institute of Western Australia (REIWA) has called the WA First Home Owners Grant (FHOG) to be altered from $10,000 for new homes only to $7,000 for new and $3,000 for existing (or established) – learn why in Perth Now

- Queensland first home buyers on the rise – According to the Australian Bureau of Statistics the quantity of first home buyer home loans are on the rise – see by how much in Domain

- How do I know if I am ready to buy my first home? – There is much to consider when working out whether or not you are ready to buy your first home – see what to consider and how much you need in FHBA News

Current Hotspot in Focus: Geelong

Every fortnight we take a closer look at an area in Australia that is popular with first home buyers. Revealing the latest first home buyer hotspot – Geelong, Victoria.

- Geelong is located 75km to the south of Melbourne

- Geelong has absolutely everything you need, transport, hospitals, schools, a great lifestyle and affordably priced housing!

- Geelong is set to be even more popular with first home buyers on the back of new stamp duty exemptions and the regional Victorian First Home Owners Grant of $20,000 that commenced on the 1st of July.

Learn more about Geelong including current opportunities to enter the Geelong property market

Current first home buyer hotspot: Geelong

Capital City Property Price Movements – as at 24/July/2017

Updated daily, The CoreLogic Daily Home Value Index shows how property prices have been changing in our largest capital cities over the last 12 months. It is interesting to note that in the quarter to the 24th of July long time falling Perth has seen a rise in property values, out performing Adelaide and Brisbane. Meanwhile, Melbourne and Sydney continue to see big increases in values.

- Adelaide: 483.26 (Qtr – 0.6% / Yr + 2.4%)

- Brisbane: 556.54 (Qtr + 0.0% / Yr + 3.8%)

- Melbourne: 942.61 (Qtr + 3.8% / Yr + 16.7%)

- Perth: 569.42 (Qtr + 0.7% / Yr – 2.9%)

- Sydney: 1136.10 (Qtr + 2.4% / Yr + 13.4%)

(Source: CoreLogic)

Interest Rates Update: 24/July/2017

Last week the Reserve Bank of Australia (RBA) confused everyone in regards to what will happen to the cash rate next (and when). This was summarised in a Facebook post by us today (see below). All eyes will now be on the RBA to see what else they have to say at next Tuesday’s board meeting.

- Compare a range of high-interest savings accounts

- Compare a range of home loan rates

- Speak to a home loan expert

- Last chance: July home loan specials!

https://www.facebook.com/fhbah

New Homes of the Week (edition 64)

These are our top picks for First Home Owner Grant (FHOG) eligible properties this week! All the homes are affordably priced for aspiring first home buyers:

New South Wales new home of the week

Queensland new home of the week

South Australia new home of the week

Western Australia new home of the week

Looking for city views and modern living? This apartment has this and more

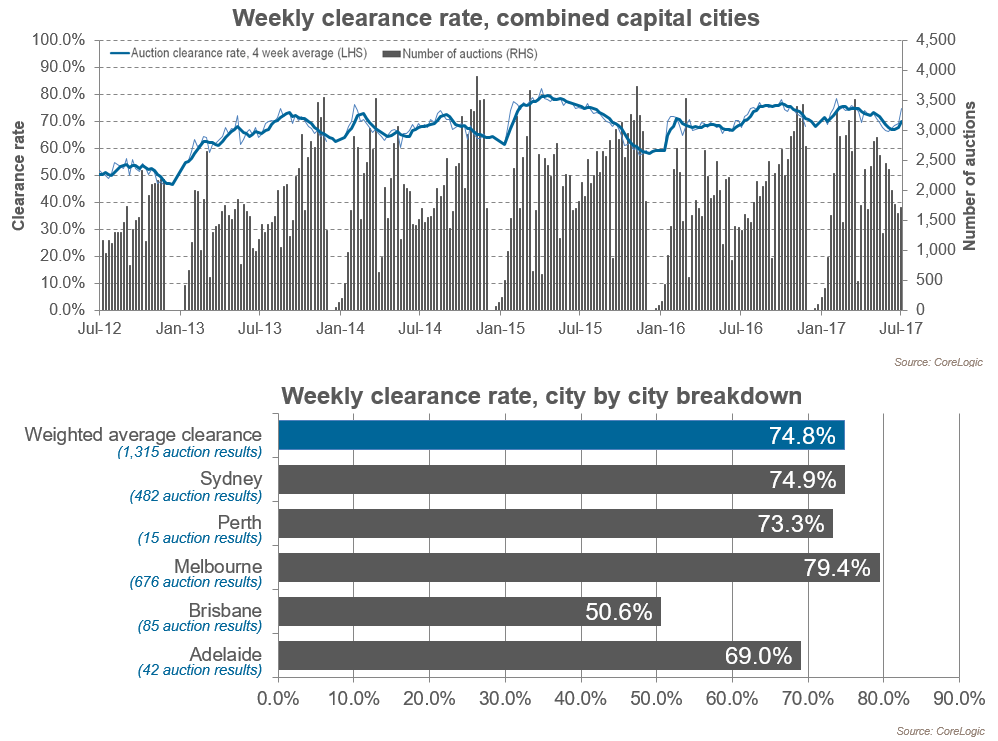

Preliminary Weekend Auction Clearance Rates (22 – 23 July 2017)

(Source: CoreLogic)

Tweet of the Week

At least some level of reform is required to CGT + neg. gearing #ausproperty #fhba #auspol @PhilWillmington @Bowenchris @ScottMorrisonMP https://t.co/cEnEGPgLKC

— FHBA (@fhba_com_au) July 20, 2017

Missed a previous FHBA Market Update? Click here to catch up now

Written By,

First Home Buyers Australia